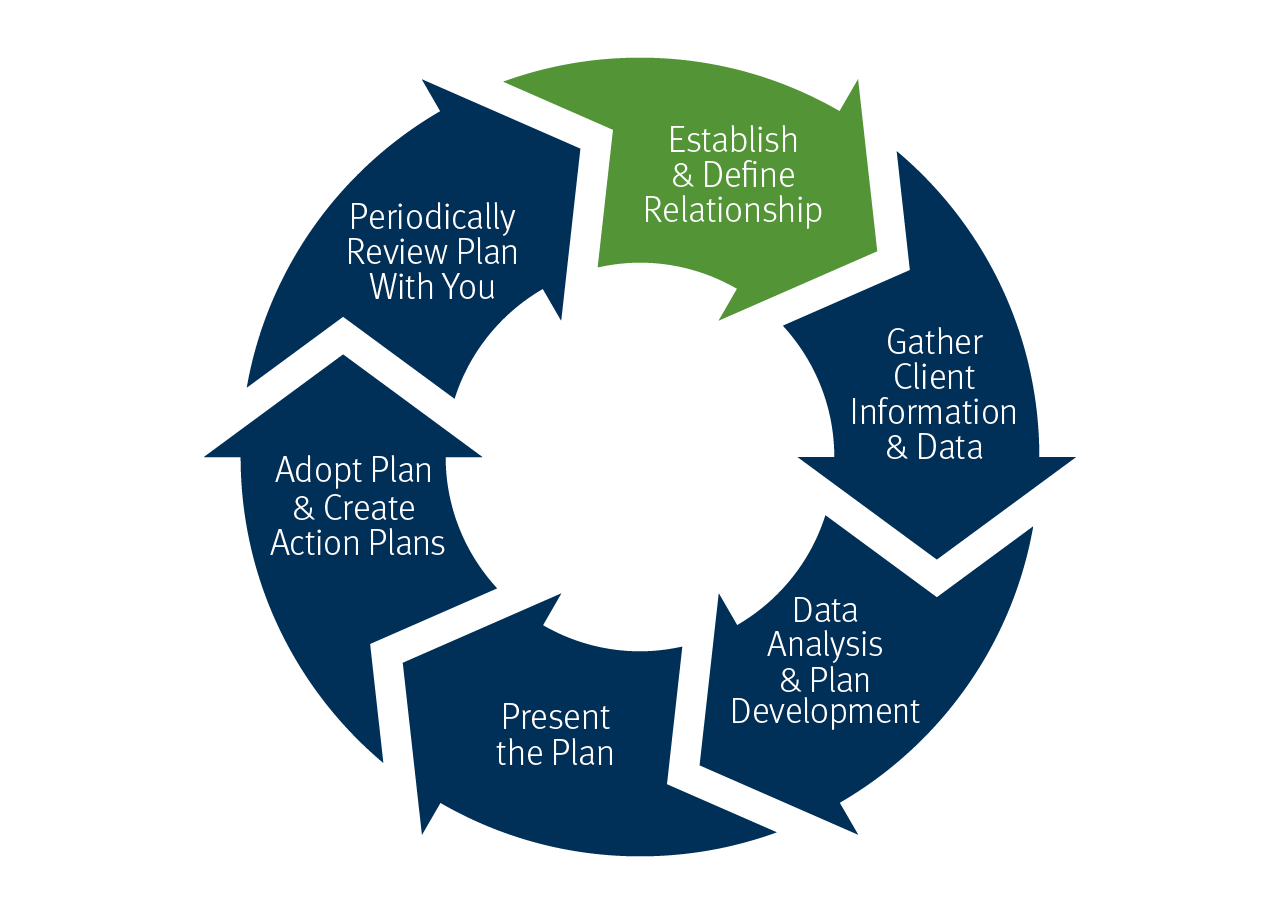

Our Approach

Taking a holistic approach to investing, our consultative process seeks to help you:

1. Build your assets according to your risk tolerance using asset management and tactical market strategies.

2. Maintain your assets through asset allocation, risk management strategies, and income conversion strategies.

3. Mitigate risk to your assets using an absolute-return approach to asset management.

4. Transfer your assets in a tax-advantaged manner through estate planning strategies, gifting, and beneficiary consultation, as well as suggesting a legal review to help ensure assets are titled correctly.

We strongly believe that by developing a thorough understanding of your financial needs, we are better able to build an investment strategy that is unique to your lifestyle and aligns with the retirement you envision.

Asset allocation does not ensure profit or protect against loss. Stifel does not provide legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation.

1. Build your assets according to your risk tolerance using asset management and tactical market strategies.

2. Maintain your assets through asset allocation, risk management strategies, and income conversion strategies.

3. Mitigate risk to your assets using an absolute-return approach to asset management.

4. Transfer your assets in a tax-advantaged manner through estate planning strategies, gifting, and beneficiary consultation, as well as suggesting a legal review to help ensure assets are titled correctly.

We strongly believe that by developing a thorough understanding of your financial needs, we are better able to build an investment strategy that is unique to your lifestyle and aligns with the retirement you envision.

Asset allocation does not ensure profit or protect against loss. Stifel does not provide legal or tax advice. You should consult with your legal and tax advisors regarding your particular situation.